Stablecoins are crypto's hidden money printers

UPDATE: Circle's USDC is generating (a lot) more fees than Ethereum!

This article was originally published on Aug 18th, 2022 as a Twitter thread

USDC is crypto‘s silent money printing machine 💵💵💵

Doing $1B+ ARR, might soon surpass #ethereum 🤯 as the highest revenue generating crypto project and likely IPO in 2022

(Update: it did)

How are they doing it?

1/ USDC is the definition of Product-Market fit

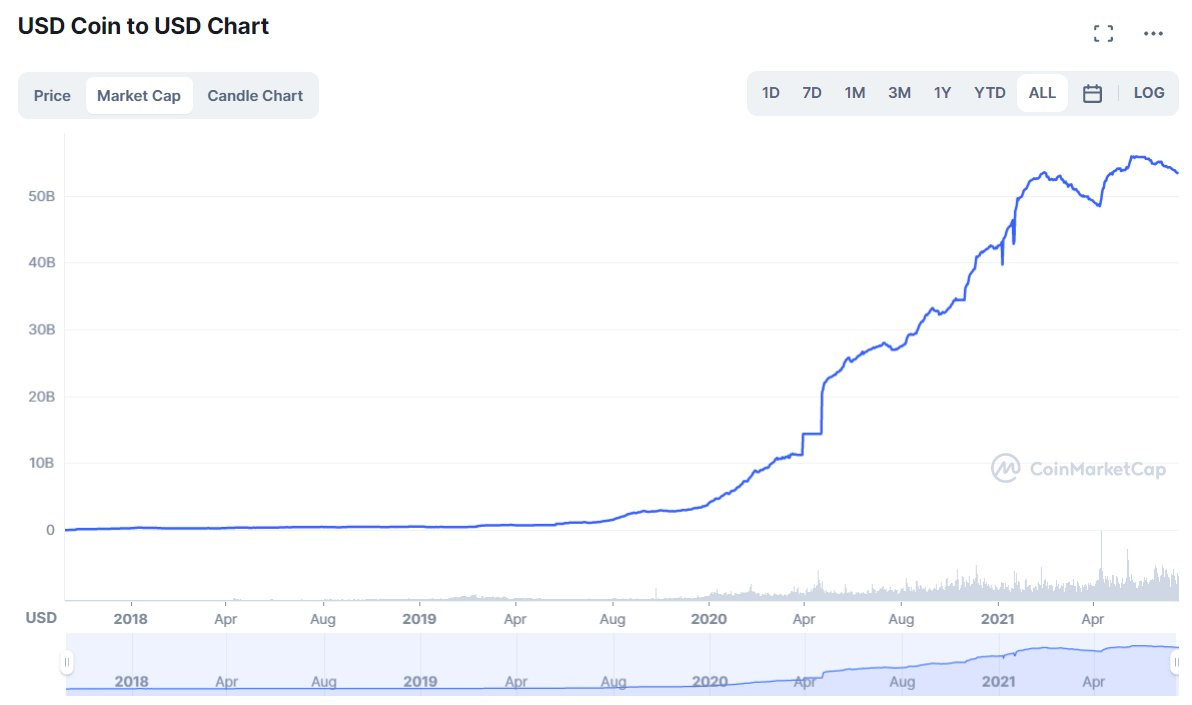

They grew by x100 in the last 3 years without any of the gimmicks that are commonly seen in other crypto projects.

They went from zero in Dec 2018 to $55B!

2/ Why is USDC so successful?

Credibility

There will always be an USD for each $USDC issued.

100% of USDCs are collateralized with either cash (20%) or US denominated government bonds, aka "T-bills" (80%) - and the assets are held by a regulated 3rd party

3/ How does USDC make (so much) money?

Basically USDC is a web 2.5 bank:

They gather deposits from Web3 users who want to hold USD in crypto format

The market demand for trustworthy stablecoins is SO high they don't need pay any yield on these deposits. 0%. Nada!They turn around and lend those deposits to the US Treasury, currently at a rate of ~2.7%

NOTE: Circle keeps 20% as cash to ensure liquidity in case of a slight increase in USDC redemption@circlepay publishes their holdings, so we can do a "back of the envelope" revenue estimation:

ARR = USDC issued * 80% * TBill APY%

The math results on $1.1B ARR!

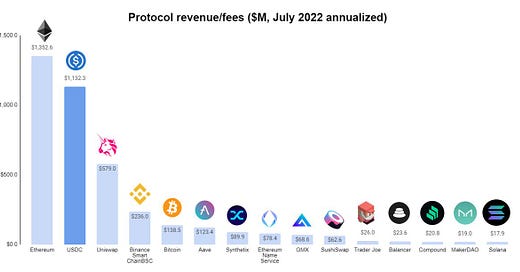

At $1B ARR, USDC is the 2nd largest protocol by revenue, a close second to Ethereum and above other large revenue protocols such as @AaveAave, @Uniswap, #BTC, #BSC as per cryptofees.info

NOTE: Eth revenue has fallen dramatically in the recent months.

USDC has two great tailwinds: rates and size

Revenue will continue to grow if the FED keeps hiking interest rates (very likely) 📈

And…USDC will most likely continue growing, especially during the next bull market 📈📈📈

Cirlce is a highly efficient business.

With an ARR of $1.1B and only 806 employees (per LinkedIn), revenue per employee is $1.4M !

That takes @circlepay to the top 5 most efficient tech companies, well above Ebay, Microsoft, Paypal, Twitter and many others!

SOME CAVEATS:

1. USDC actual revenue is a weighted average on their TBill positions, which change weekly with expired and new placement amounts and rates.

Our estimation assumes constant USDC supply, interest rates and investment strategy

2. Revenue does not account for other BUs.

USDC is not the only source of revenue for Circle. Their July 2021 SPAC filing showed TTS revenue as higher than USDC, but unlikely that is the case today.

Link to 2021 filing: circle.com/hubfs/investor…

What comes next?

Circle is now replicating the magic formula on other assets, most recently with the Euro (EUROC)

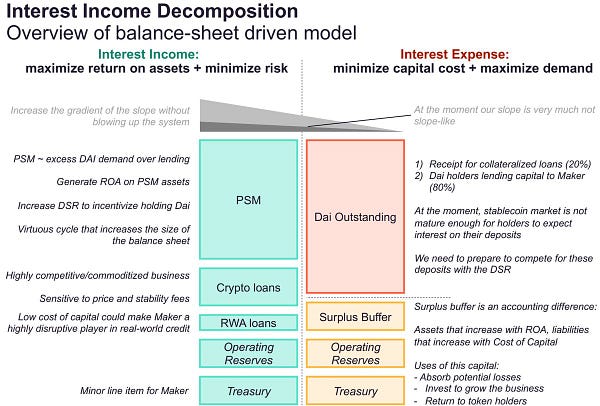

And they are not the only ones - MakerDAO is also looking to get a piece of that pie, as per MakerDAO RWA lead @SebVentures

And MakerDAO will not be the last one to join the party.

Where there is a Wells Fargo that pays ~0% on deposits, there is a Marcus that pays ~1.7%, passing over a portion of revenues to attract consumers.

Financial Times predicts (and I agree) commercial banks will increasingly look at crypto as a source of deposits.

Expect banks to start announcing launching tokenized deposit/notes soon!

The future of stablecoins is commercial bank money

And seems like an IPO is coming soon!

(UPDATE Dec 27th 2022: SPAC got cancelled)

According to Circle’s pressroom, the company will go public via SPAC at a $9B valuation (up from the $4.5B price tag from the 2021 filing) on Dec 8/2022.

Circle Valued at $9BCircle and Concord Acquisition Corp announce new business combination agreement. Circle’s value doubles to $9B. Learn more about this valuation today!https://www.circle.com/en/pressroom/circle-valued-at-9b-in-new-transaction-terms-agreed-with-concord-acquisition-corp

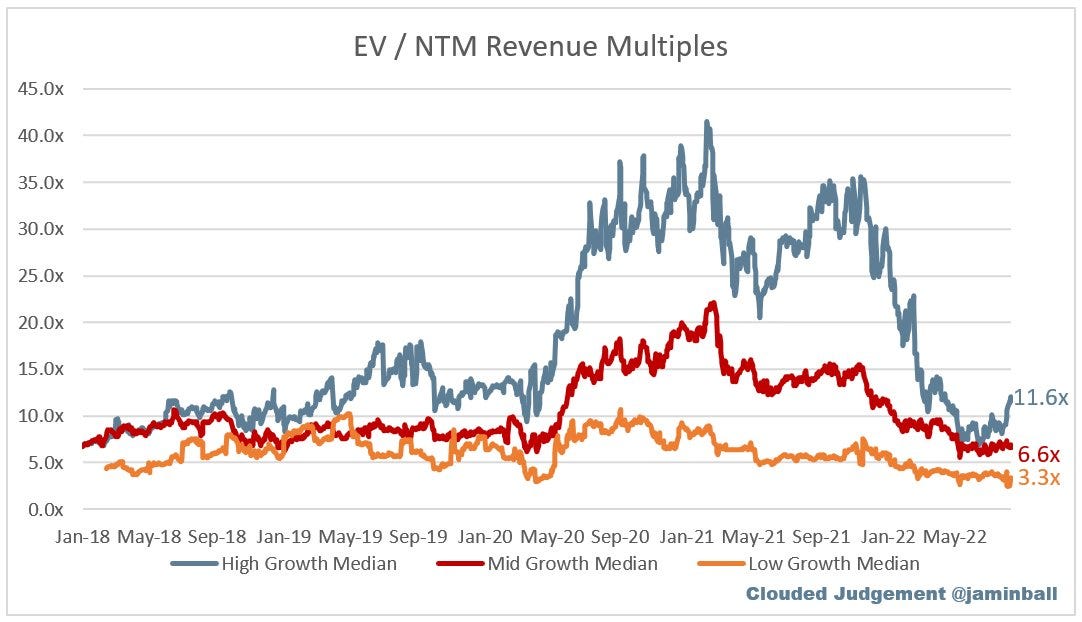

The $9B valuation represents a roughly 8x multiple.

According to @jaminball ‘s SaaS revenue multiples, and given Circle's growth is well above the High-Growth group, we might see a new revision for this valuation.

Excited for this IPO and seeing this foundational crypto infrastructure company continue to grow.

Also looking forward with all the innovation that higher interest rates will bring to the ecosystem.

Hope you've found this thread insightful and share it for others.

Update Sep 1 - USDC is now the largest fee generator - ETH fees are at ~0.85B vs 1.1B for USDC!